While ideally you could avoid such. This can be seen as an excessive favor.

Expat Diaries In Malaysia It S Never Too Late To Dream A New Dream This Village Girl Travel Obsession Expat Expat Life

Youll have to pay more if its later or if you pay your tax bill late.

. Fully integrated solution. The interest rate is applied until the remaining tax amount is wholly cleared. Give customers more flexibility at checkout by letting them pay in 4 interest-free payments or monthly installments up to 12 months Log in to check eligibility.

Flexible payment options Pay however you want. Do a quick check on the personal loan settlement calculator if you are planning ahead on your financial commitments. If GST is not paid within the due dates of filing.

Besides encouraging clients to pay an overdue payment fee is a good idea for several other reasons. Pay in 4 zero-interest instalments. No hidden fees Only pay for what you purchase.

Doing so will result in the higher filing penalties stopping once you have filed. Youll be charged interest on. Input Tax Credits cannot be used to pay off GST penalties.

Get an ASB loan at interest rates as low as 4. Shopping freedom like youve never experienced. In tough times cash flow is especially important.

10000 Payment Due Date. Tap into Shops 100M user base. ربا الربا الربوة ribā or al-ribā IPA.

The interest rate is set to 1 until end-2022. Non-Business or June 30 th July 15 th Individual. Credit or debit card FPX payment direct debit we accept them all.

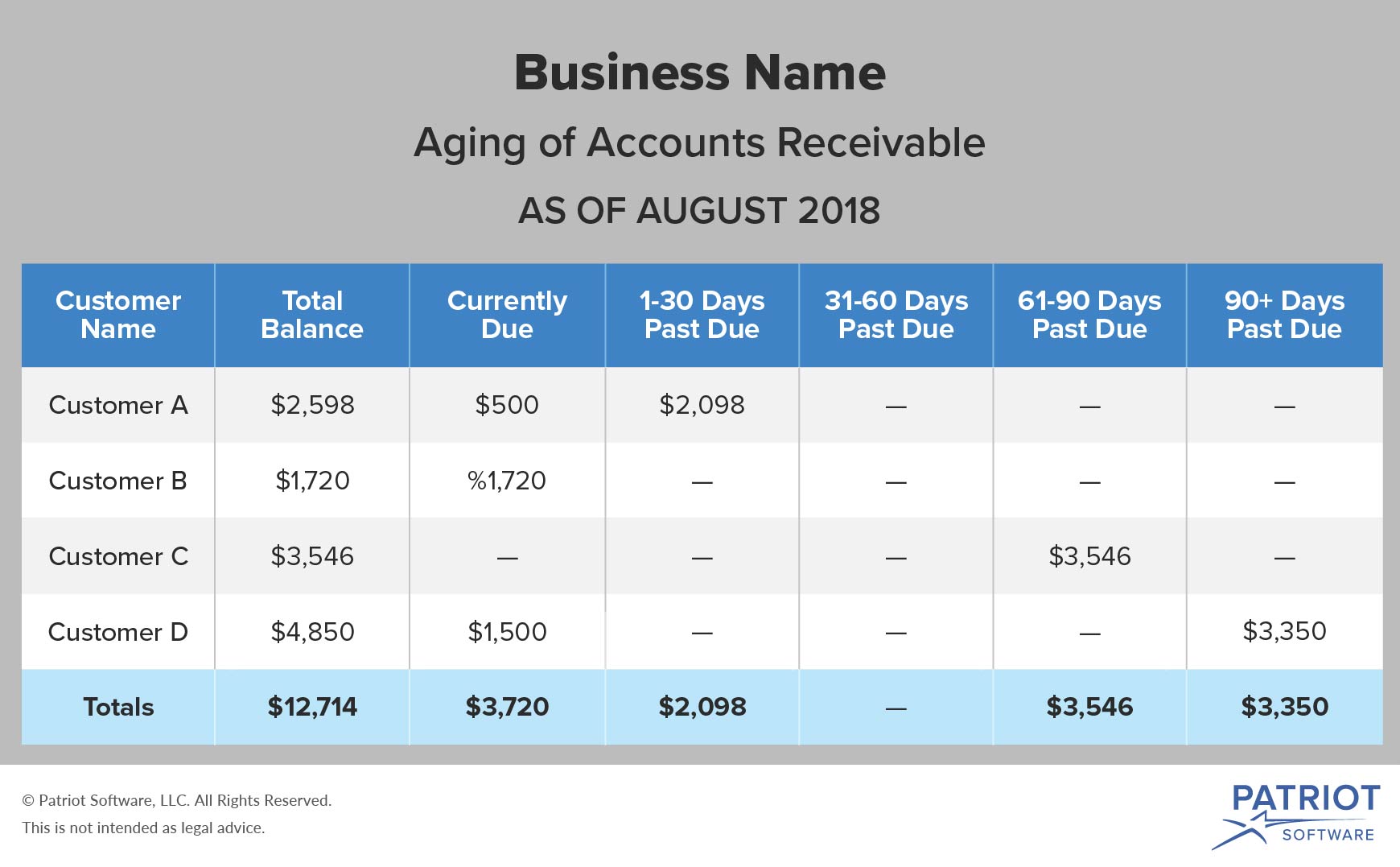

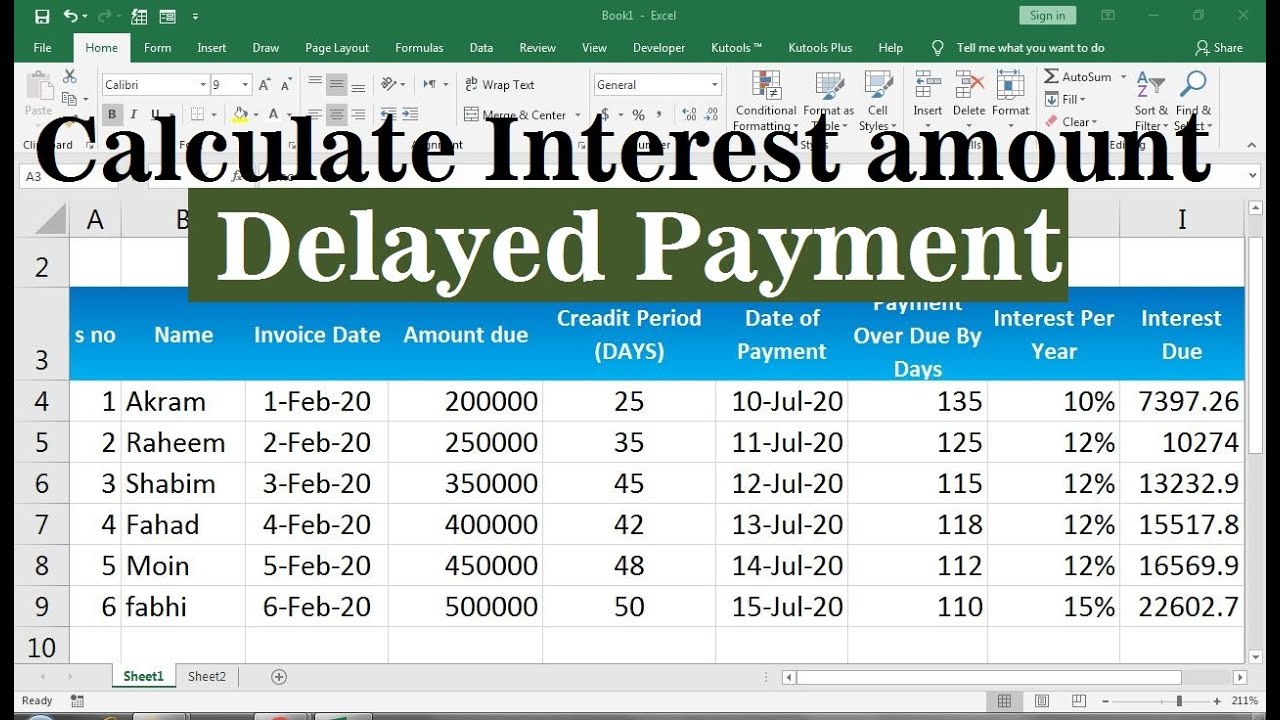

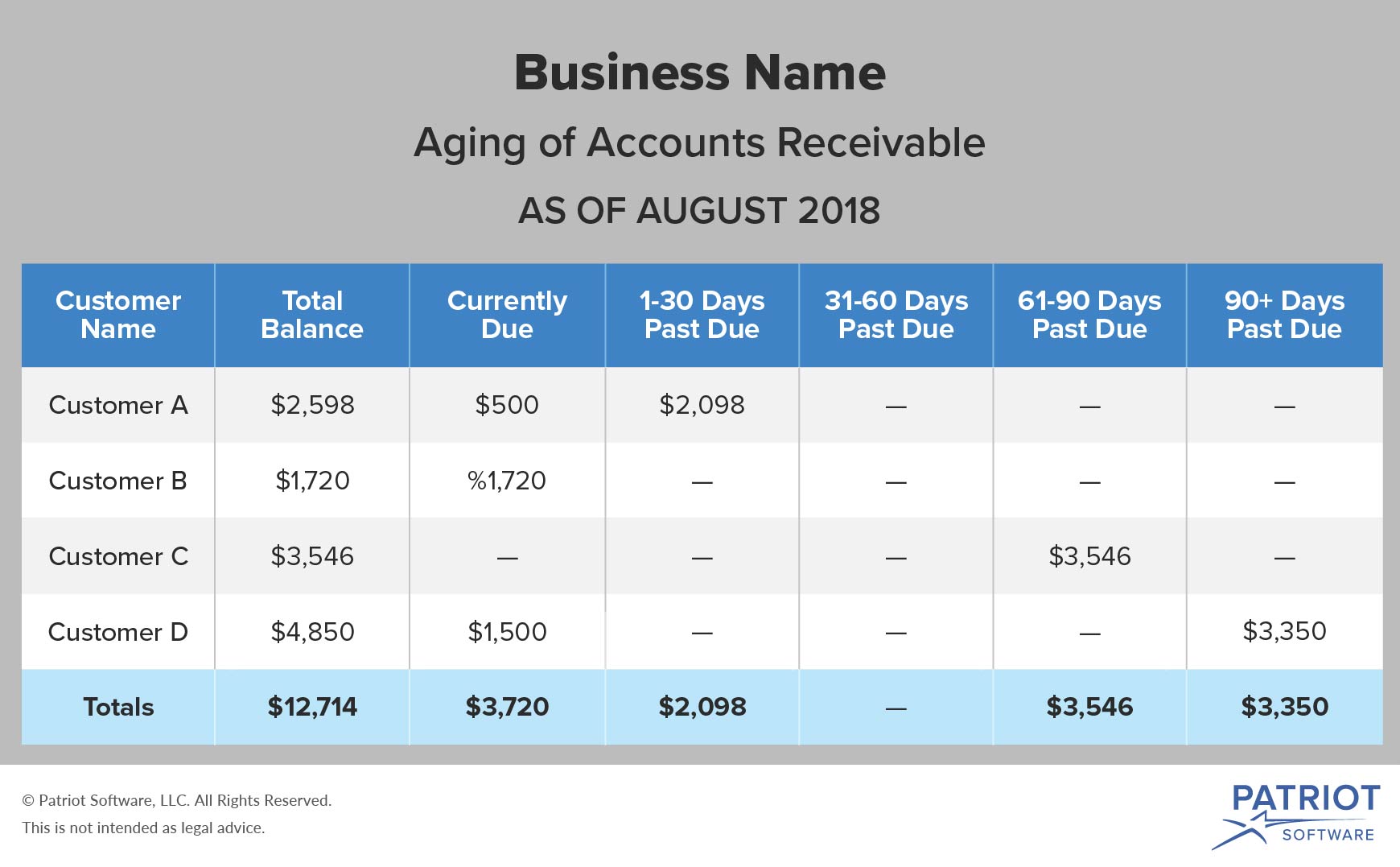

Up to 18 pa. Why Charging Late Payment Fees Can Be a Good Idea. Subtract that interest from your fixed monthly payment to see how much in principal you will pay in the first month.

We provide all the forms tax calculators and tools for previous. Late payment fees can be an added incentive to get clients to pay you sooner. Missing deadlines or paying less than the mandated amount in any due period implies a levy of 1 Simple Interest SI on the remaining tax amount.

Riba is mentioned and condemned in several different verses in the Quran 3130 4161 3039 and perhaps most commonly in 2275-2280. The late filing penalty 45month of the tax amount owed plus interest is larger than the late payment penalty 05month plus interest. No catch just guilt-free spending.

Payment of Labuan Business Activity Tax Assessment Fixed Rate RM2000000 23. It is also mentioned in many hadith reports. Reduces excess output tax liability.

18 AugTransaction incurred on 15 Aug. Payment for LBATA Assessment 24 of Business. Maximum rate of interest is 6 without a contract.

Pays CGST SGST or IGST after the due date. As a result as of the second quarter DSME has yet to pay 1192 billion won of interest on the debt. Late Payment Charges for charge cards.

Even financially healthy companies are struggling with borrowing money at high interest a shipbuilding industry official said. 4 zero-fee instalments Shop now pay later in 4 zero-fee instalments. March 21 2020 The Treasury Department and the Internal Revenue Service are providing special tax filing and payment relief to individuals and businesses in response to the COVID-19 Outbreak.

The filing deadline for tax returns has been extended from April 15 to July 15 2020. Interest rate is charged on the outstanding balance when partial to zero payment is made after a 20-day interest free period. If the tax and penalty imposed is not paid within 60 days from the date the penalty is imposed a further penalty of 5 will be imposed on the amount still owing.

Interest is applicable on late payment of GST liability on the net tax liability after reducing the input tax credit claims. Makes a delayed GST payment ie. Youll pay a late filing penalty of 100 if your tax return is up to 3 months late.

If you were supposed to get a refund with the late return you could lose the refund depending on how late you file. 0 easy payment plan for 6 12 24 or 36 months Full payment Full ownership Low monthly commitment Flexible repayment tenure 0 interest rate Missing a monthly EPP payment will cause the 0 interest rate. Is an Arabic word that can be roughly translated as usury or unjust exploitative gains made in trade or business under Islamic law.

Again file you return and pay as little or as much as you can afford or even nothing. You can lose your refund. If late payment interest is calculated to be less than RM5 then interest is charged at RM5 per month.

Interest rate is 6 per annum unless a different rate is prescribed in NY CLS Banking in which case legal interest rate is 16. Up to 28 fewer abandoned carts. The IRS will also charge you interest until you pay off the balance.

Rate of interest shall not exceed 15 without a written contract. Appeal Against Tax Increase For Delay In Income Tax Payment. Get started with a 14-day free trial.

Interest on the late payment of contributions will be charged at the rate of 6 per annum for each day of late payment contributions. Claims excess input tax credit. 1 Aug Statement Balance.

The penalty for filing late is 5 of the taxes you owe per month for the first five months up to 25 of your tax bill. If your lender has told you that your fixed monthly payment is 43033 you. Payment of Labuan Business Activity Tax Assessment 3 on Chargeable Income 24.

Compare ASB Loans in Malaysia 2022. In partnership with Up to 50 increase in average order value. If you failed to make the full payment after April 30 following the year of assessment you will be charged a late payment penalty of 10 on the balance of tax not paid.

If the company or cardmember fails to settle the outstanding balance in full by the due date a late payment charge of 35 of the Card Account on the balance or RM5000 whichever is higher will be imposed and stated in the monthly statement. Compare the best ASB loan options in Malaysia. You need the moneyASAP.

1 Sep In this case interest will be charged for Rs 10000- from 2 Aug till 17 Aug and the unpaid balance of Rs 2000 will attract interest from 18 Aug till 1 Sep. Late fees are determined automatically and are reported in the GSTR-3B for the following month. A late payment of 10 will be imposed on the balance of tax not paid after April 30 th May 15 th Individual.

Payment of Compound Under Labuan Business Activity Tax LBATA 25. The interest has to be paid by every taxpayer who. Late payment of advance taxes can attract fines.

For example January contributions should be paid not later than February 15th. The IRS urges taxpayers who are owed a refund to file as quickly as. Dont have a Shopify store.

Interest on the other hand must be computed manually and filed into the GSTR-3B for payment. Rs 8000 received on 18 Aug Current Statement Date. For CGST SGST and IGST late fees and interest must be paid in cash separately.

Deferred Advance Tax Payment. Payment for Increase Under Section 13 LBATA. Maximum rate of interest with a written contract is 16.

Late Payment Interest Calculator Excel Youtube

Late Payment Fee Process For Charging Fees On Late Payments

Gst Comes Knocking With A Riddle What Goes Up What Goes Down Malaysia Malay Mail Online Riddles Entertaining Knock Knock

Late Payment Interest Calculator For Past Due Invoices

A Minute Too Late Best Sunset Beautiful Landscapes Sunrise Sunset

A 2022 Comparison Of Buy Now Pay Later Bnpl Services In Malaysia

What Happens If You Re Late On Your Car Insurance Payment

A 2022 Comparison Of Buy Now Pay Later Bnpl Services In Malaysia

A 2022 Comparison Of Buy Now Pay Later Bnpl Services In Malaysia

Nice Buddha By Alvin Chong From Malaysia Buddha Tattoo Design Buddha Tattoos Buddha Tattoo

Expat Diaries In Malaysia It S Never Too Late To Dream A New Dream This Village Girl Travel Obsession Village Girl Expat

A 2022 Comparison Of Buy Now Pay Later Bnpl Services In Malaysia

A 2022 Comparison Of Buy Now Pay Later Bnpl Services In Malaysia

Expat Diaries In Malaysia It S Never Too Late To Dream A New Dream This Village Girl Asia Travel Expat Life Expat